Personal Investment Loans

Set yourself up for success

Build your wealth, and your future

Our flexible financial solutions can empower you to invest in art, memorabilia, real estate, NFTs, and more — so that you can establish your legacy.

Streamlined application

Secure new assets with ease

You work hard — getting the funds to invest in new ventures should be easy. We provide flexible personal investment loans fast, with no personal collateral requirements.

Industry-leading personal loan features

We provide a best-in-class lending experience that will meet your needs — and exceed your expectations.

- Large loan amounts – up to $200,0001

- Affordably low monthly payments

- May be approved in as little as 24 hours*

- Funding in as few as 5 days*

- Premium service 7 days a week

- No personal collateral required

- No lockout period or prepayment penalty

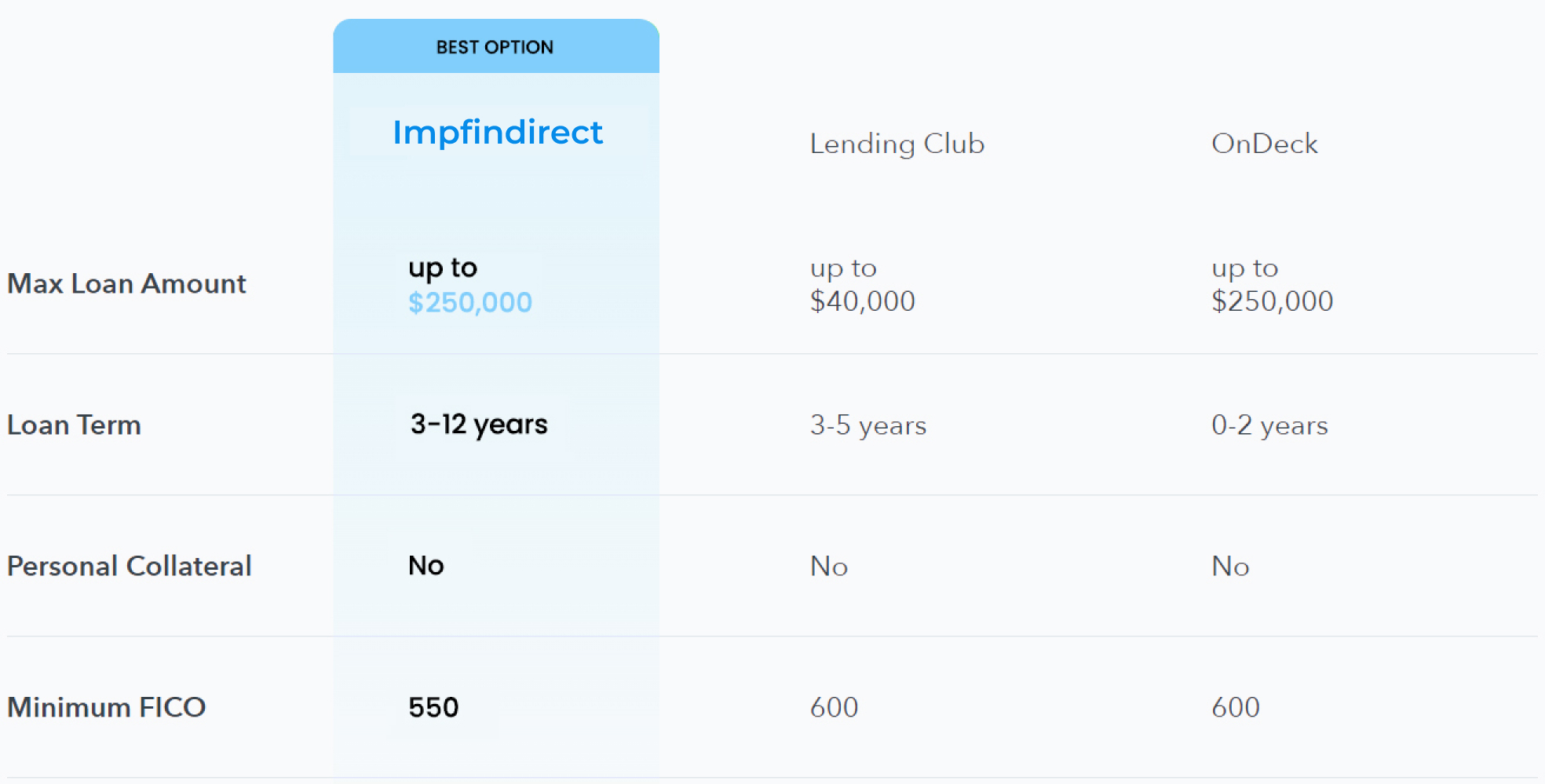

What separates impfindirect from other services

From long-term investment to short-term financing, impfindirect has the antidote to your problem

A partner to help you get more out of tomorrow

With twenty years of experience and real-life examples, you can be confident that we’ll provide you with a solution that helps you invest now and reap rewards later.

How to get your personal investment loan

Streamlined Application

Get started online or apply over the phone with

no cost or commitment.

Quick Approval

Submit minimal documentation and you may be approved in as little as 24 hours2.

Fast Funding

Review your terms and receive your funds via

wire transfer in as few as 5 days2.

Let’s find the right loan to fit your needs

Understanding Personal Investment Loans

What can I use a personal investment loan for?

You can use our loans to invest in various areas. For example, you can invest in artwork, memorabilia, real estate, and even non-fungible tokens (NFTs).

How do I get a personal investment loan from impfindirect?

To take a personal loan for investment purposes from impfindirect, simply follow these steps:

1. Estimate your payment in as few as 30 seconds

2. Apply online or call our US-based team 7 days a week

3. Get funded in as few as 5 days2

Can I use a personal investment loan for more than one purpose?

Yes. Our personal loans can be used for investments in various areas, as well as for other personal uses. For example, you can use our funds to buy artwork, pay for a vacation, and consolidate your personal debt.

Why should I choose a impfindirect personal loan to fund my investments?

While other lenders may provide personal loan amounts up to $50,000 or $100,000, at impfindirect, we provide amounts from $20,000 up to $200,0001. You can use our large loan amounts to build your wealth with funding in as few as 5 days2 and approval in as little as 24 hours2.

Will applying for a personal loan for investments impact your credit?

Unlike lenders who perform a full credit inquiry during the application process, at impfindirect, we only perform a complete credit inquiry of your credit at the funding stage. Therefore, applying will not impact your credit.

View your estimate

No application fees, commitment, or impact on personal credit to estimate your payment.

Personal loans not currently available in Illinois or Maryland

- Loan sizes, interest rates, and loan terms vary and are determined by applicant’s credit profile. Finance amount may vary depending on your state of residence. Call for complete program details.

- This is not a guaranteed offer of credit and is subject to credit approval.

- There is no impact on your credit for applying. A complete credit history, which will appear as an inquiry on your credit report, will be performed upon acceptance and funding of a loan.